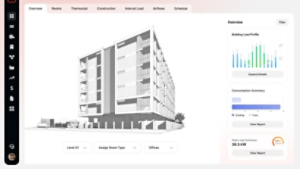

Is Thermal Energy Storage Right for Your Building?

Electrical rates and rate options

Commercial electricity rates can be very confusing. Regardless, they all have something in common. Buying electricity during off-peak periods, typically at night, is almost always less expensive.

Commercial vs Residential utililty rates

Commercial and Residential electric bills are calculated differently. Residential rates charge you for your energy usage only, so consumed kilowatt-hours (kWh) are multiplied by a constant cost, for instance 10 cents per kWh. Commercially you are charged for your kWh consumption and you are also charged for your monthly peak usage, called Peak Demand, which is in kilowatts (kW). Since most building are used during the day this demand charge added to daytime costs of electricity.

For example, a standard commercial rate may have the same energy charges day and night. However, lowering peak demand during daytime hours lowers the Demand Charge on the electricity bill. Therefore moving consumption of electricity to off peak periods at night will save money.

What about “Flat Rates? In a deregulated marketplace “Flat Rates” may be offered and they may not show any difference between day and night rates. However, the flat rate is usually determined by analyzing the buildings historical consumption. Buildings that consume a good portion of their electricity during peak periods will have a higher cost flat rate than a building that shifts consumption off peak. Both of these rate names, standard demand rate and flat rate, do not indicate a time of use savings but there are time of use saving opportunities.

Acceptable ROI for your project

A simple payback calculation is often used to analyze how long an investment in an efficiency upgrade takes to recover costs of the investment. If a building owner invests $1,000,000 in upgrades and the efficiency measure saves $200,000 annually, the investment has a simple payback of five (5) years.

Do the math

The formula is easy to calculate, divide the investment by the annual savings. In this case, after the fifth year, the savings are “gravy.” Simple payback is used because it is straight forward and quick. However, the use of simple payback makes it very easy for managers to set tougher energy upgrade financial standards than other investments, within the business, require. It’s not uncommon to hear that some companies require energy investments to pay back in only two years, or even 18 months!

How to calculate payback

A better method of communicating investment measurements to financial managers might be Return on Investment (ROI). How does the energy upgrade investment compare to other business investment opportunities? That simple payback calculation of 5 years sounds like a long time but it equates to an ROI of 20%. A twenty percent return is a very solid investment! A four year payback has an ROI of 25%, a three year payback has an ROI of 33% and that two year simple payback requirement equates to an ROI requirement of 50%.