The Outlook for U.S. Passenger Electric Vehicles

August 23, 2017

There are three main types of electric vehicles (EVs): Hybrid Electric Vehicles (HEVs, which are powered by both petrol and electricity), Plug-in Hybrid Electric Vehicles (PHEVs), and Battery Electric Vehicles (BEVs). Using an electric motor for propulsion, EVs can be powered through a collector system by electricity from the grid, or they can be self-contained with a battery, solar panels, or a generator to convert fuel into power. EVs are promoted as a way to reduce oil consumption and lower greenhouse gas emissions.

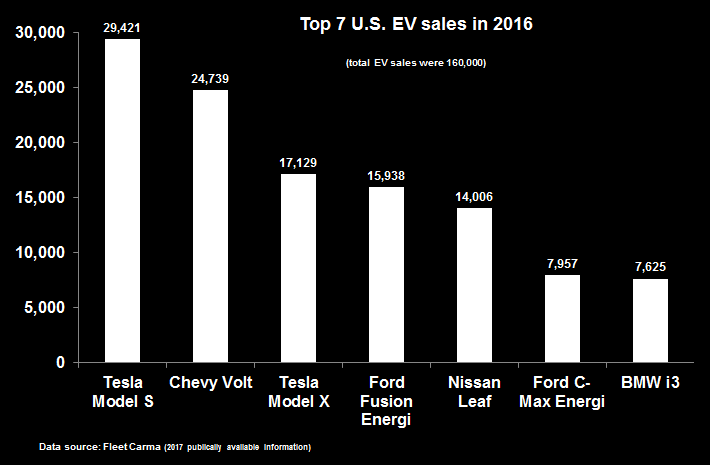

Although EVs are gaining in popularity, they remain a niche market. The movement today is being spearheaded by Tesla, Inc and its founder and CEO, Elon Musk. Since the beginning of 2017, Tesla's market capitalization has surged to over $60 billion, rivaling that of General Motors. Clearly, the main objective of the industry is to create an EV with a realistic sticker price for the typical American family. Tesla is pushing into the mass market with the new Model 3 sedan. And the world’s largest automaker, Volkswagen, now plans four affordable EVs in the coming years, seeking 2 million units sold a year by 2025.

A stronger future seems assured. In July, Volvo announced that all of its vehicle models launched after 2019 will be electric, becoming the first traditional automaker to phase out vehicles powered solely by the internal combustion engine. Mercedes-Benz has accelerated the introduction of 10 new EV models by three years to 2022. At the national level, many countries seek EV adoption to meet environmental goals set under the Paris COP21 climate accord. For example, both Great Britain and France have promised to end sales of traditional internal combustion engine vehicles by 2040.

Despite strong governmental incentives to extend EV adoption, their higher upfront prices can be prohibitive, namely because of the high cost of the battery. For example, Tesla's Model 3 starts at $35,000, but additional features can push the final price tag up to $55,000. Even though the initial cost may be higher, EVs can cost far less to run on a per-mile basis.

- The average price of U.S home electricity is $0.125 per kWh, and a typical EV consumes 34 kWh of battery power to travel 100 miles. Thus, it costs $4.25 to travel 100 miles in an EV.

- The average fuel economy for traditional U.S. gasoline vehicles is 25 miles per gallon, and gasoline costs nationally are now $2.35 per gallon. Thus, it costs $9.40 to travel 100 miles in a gasoline vehicle, more than double the EV price to travel that distance.

- In other words, using 15,000 miles as the average amount of miles an American drives in a year, the annual fuel cost of an EV would be less than $640, compared to $1,410 for a gasoline vehicle.

And importantly, today’s oil and gasoline prices sit at historic lows, with prices expected to increase – perhaps very significantly. The U.S. Energy Information Administration’s Annual Energy Outlook 2017 forecasts electricity rates increasing by just 0.4% per year through 2040, compared to 1.3% for gasoline prices. Moreover, power prices for EVs can be less than normal rates, with incentives for off-peak charging and/or funneling the extra power in an EV back into the grid.

Ultimately, Tesla’s primary goal to create a lower priced EV battery is critical to broad adoption. Elon Musk’s new business model to merge the EV and renewable energy industries is a powerful concept because they both could greatly benefit by lowering battery storage prices to grow their appeal. An EV and renewable power coordination could help create “the cleanest vehicle possible.”

The good news is that EV lithium-ion batteries have dramatically dropped in price over the last five years. According to Global Trends in Renewable Energy Investment 2016 from the United Nations Environment Program, the global average cost for an EV battery in 2015 was below $350 per kWh, down 65% from the $1,000 per kWh cost in 2010. The industry estimate is that once batteries reach $150 per kWh, a plausible figure for 2020, EVs will be highly cost-competitive with gasoline vehicles.

To figure the environmental benefits of a large-scale EV fleet, one of the most important questions to ask is “How much electricity do EVs require?” That can be estimated in four steps:

- The U.S. consumes approximately 138 billion barrels of gasoline each year, and the average thermal energy content in gasoline is 33.41 kWh per gallon.

- Thus, 4,443 TWh per year would be required for U.S. gasoline use to be displaced by electricity

- But, the U.S. Department of Energy’s (DOE) Alternative Fuels Data Center notes that “Electric drivetrains are about four times more efficient than internal combustion engines,” indicating that it would take only 1,111 TWh of electricity to displace gasoline.

- With 2016 U.S. electricity consumption at 4,050 TWh, the yearly increase in our power needs to displace all gasoline vehicles with electric vehicles would be approximately 27%.

As for the other logistics of EVs, Tesla Model 3 claims a range of 250 miles per charge, far more than the average U.S. commute of 30-40 miles. A recent study at Columbia University’s school of Engineering and Applied Science found that EVs could eventually meet as much as 95% of all daily driving needs of U.S. citizens. And if batteries keep decreasing in price at the current rate, the DOE’s Argonne National Laboratory predicts that EVs will make up nearly 60% of the U.S. light vehicle market by 2030.