Two attempted Capacity Reforms in MISO come to naught

March 16, 2017

In the past weeks, two different efforts to change MISO’s capacity system have concluded. One, an in-the-weeds discussion on how transmission affects capacity pricing, ended with a notation being added to the already 6,200 page MISO tariff. The other, an attempt to set up a forward capacity market similar to that seen in PJM, was rejected by FERC. These two efforts represent how both top-down and bottom-up reforms can fail in an ISO system, even when all parties want them to succeed.

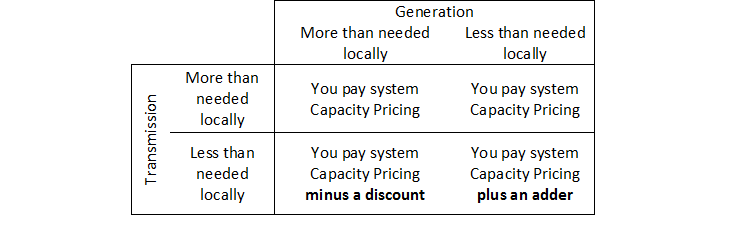

Capacity within an ISO starts as a universal system price, meaning that the entire system has the same initial capacity price before zonal adders are factored in. These adders are dependent on balance of transmission and generation within the zone. For example, if you are in a zone with little generation, you are not penalized so long as adequate transmission exists to get needed power at peak times. If inadequate transmission exists, the system price is decreased if there is more generation than demand and increased if there is too little.

Within MISO, transmission constraints were not typically a problem until the auction for the 2015/2016 season. That year, Zone 4 (Illinois) became “constrained,” driving its price to $133.00 per megawatt-day, nearly 40 times the system price of $3.48. The following year, changes in generation capabilities and a FERC order regarding how capacity could be exported to PJM upped the system price to $72.00 per megawatt-day. Of the 10 MISO zones, four payed below this cost with three paying only $2.99 per megawatt-day. The three zones with less expensive capacity were Arkansas, Mississippi, and Louisiana (Zones 8, 9, and 10), and they were only tenuously linked to the rest of MISO. Then the filings began.

Generators in the South were unhappy that they were being paid so little, while loads in the North were bothered that they could not buy capacity from the South. Both claimed that MISO was inadequately judging the transmission capabilities that existed between the North and South and filed a grievance with FERC, the federal regulatory body. MISO countered that there was, in fact, not enough transmission to support sending power northward at peak times, when it would be needed most. FERC finally ruled that MISO did indeed act appropriately, however the calculations used should be published in the ISO’s tariff. In late January, these calculations were added.

The second issue recently concluded was MISO’s petitioning of FERC for their “Competitive Retail Solution” (CRS). This plan would allow Zones 4 and 7 (Illinois and Michigan, respectively), the only deregulated areas within MISO, to hold forward capacity auctions while the rest of the zones would continue with the current system, blending the two types of capacity markets presently seen in the U.S.

Forward capacity auctions, as seen in PJM and ISO-NE, are run several years in advance of when their prices will take effect. For example, PJM is currently preparing to hold the initial auction for the 2020/2021 energy year. These auctions focus on the cost of new entry for generation and are held in advance of the capacity year to give prospective generators time to construct facilities, knowing they will have stable income when the units come online. These are used in areas where utilities do not own their own generation resources.

The other capacity market design, a reserve auction such as what MISO uses, exists not to incentivize new generation but to make whole generation that is only needed at peak times. While some generation units are never economical to run under a price capped system, they are needed for capacity reasons. Non-forward reserve auctions serve to otherwise compensate the owners of these less competitive but necessary units, while also incentivizing owners to reinvest the money in more efficient and more profitable facilities.

Both of the forward and reserve auctions work best in certain situations. Forward auctions are designed to bring non-utility owned generation online at the cost of creating a more complicated process. Reserve auctions are a simpler process and are ideal for ISOs composed of mainly regulated utilities. MISO’s main problem is that it is over 90% regulated, but its deregulated areas have generation deficiencies.

By mixing these market designs, however, an odd mechanic emerges. Under the CRS, capacity would be auctioned in two of MISO’s 10 zones three years in advance. In the other eight zones, auctions would be held in April and go into effect in June. As capacity starts as a single price for the whole system, prices would be set three years in advance and then altered three months in advance. This would create a system wherein generators in non-forward market states would know pricing in advance allowing them to potentially manipulate system price. FERC ultimately took this stance and concluded CRS was too vulnerable to manipulation.

This year is seen as a year in which capacity markets would see volatility as market mechanisms get revised. Thus far, MISO has seen little change in how it is structuring its market. Capacity prices for the 2017/2018 energy year will be posted on April 14, 2017.