Commercial and industrial building owners can take advantage of incentives included in the Inflation Reduction Act (IRA) to help increase the impact of decarbonization investments. Working with experienced and knowledgeable building professionals who can help navigate the multifaceted requirements associated with each incentive is critical for maximizing the financial benefits from the IRA.

What Is the Inflation Reduction Act of 2022?

The Inflation Reduction Act (IRA) of 2022 is a significant piece of U.S. legislation signed into law by President Joe Biden on August 16, 2022. The law focuses on addressing climate change, reducing healthcare costs, and reforming the tax system to reduce the federal deficit. It represents one of the largest investments in climate and clean energy in U.S. history. The only changes to the Inflation Reduction Act in 2023 and 2024 were to details of how the law is being implemented.

Understanding the Incentives

Many of the incentives arising from the Inflation Reduction Act—notably tax credits, rebates, and deductions—existed prior to the passage of the IRA but were expanded and extended by it. The IRA supports building owners or operators to:

Improve Energy Efficiency

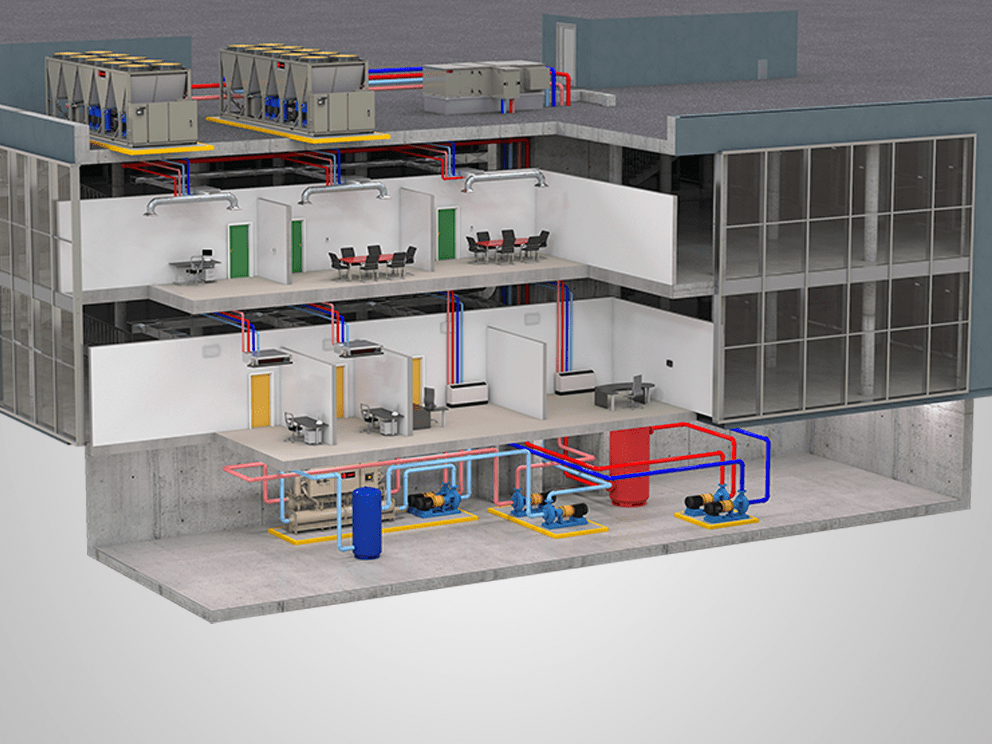

The IRA extended and expanded the Commercial Buildings Energy-Efficiency Tax Deduction, which supports major energy efficiency retrofits to buildings at least five years old. To be eligible, interior lighting, HVAC, water heating, and the building envelope upgrades must decrease building energy use intensity by at least 25%. The deduction ranges from $0.50 per square foot to $5.65 per square foot (as of 2024), depending on the magnitude of the energy reduction and whether the project adheres to prevailing wage and apprenticeship requirements. Computer modeling and verification that the project meets energy efficiency requirements is required for this tax deduction, so the retrofit plan must be designed by a professional.

Adopt Renewable Energy

Building owners have options for claiming tax credits for the adoption of renewable energy sources. These credits phase out as we move closer to 2032 or the year in which national greenhouse gas emissions from electricity production are 25% or less than the emissions from electricity in 2022, whichever comes first.

Credits based on the renewable energy installation investment include:

- the Investment Tax Credit for Energy Property (for projects that begin prior to 2025)

- the Clean Electricity Investment Tax Credit (for projects that begin 2025 and later).

Tax credits based on the amount of energy produced include:

- the Production Tax Credit for Electricity from Renewables (for projects that begin prior to 2025)

- the Clean Electricity Production Tax Credit (for projects that begin 2025 and later).

Either a production credit or investment credit can be claimed—not both. As of 2024, the Clean Electricity Investment Tax Credit provides a credit ranging from 6% to 70% of the cost of the renewable energy system. The Clean Electricity Production Tax Credit entitles building owners to a credit worth up to $2.75 per kWh of energy generated that is sold, consumed, or stored. In either case, the exact amount of the credit depends on the size of the energy system, whether prevailing wage and apprenticeship requirements are met, whether the project is located in a so-called energy community, and whether the materials used in the project meet domestic content requirements.

Install Energy Storage

The Investment Tax Credit for Energy Property can be applied to energy storage technologies such as batteries and thermal energy storage systems, with or without renewable sources, such as solar or wind. When adequate storage is used with an appropriately sized renewable energy source, facilities can operate with zero-carbon electricity 24/7. Even without on-site renewable power, standalone energy storage systems are eligible for the tax credit and can be used to store energy from the grid when demand is peaking and energy costs are high.

Install EV Charging

The Refueling Infrastructure Tax Credit provides incentives for installing EV charging infrastructure in non-urban and low-income areas between 2022 and 2033. The credit ranges from 6% to 30% of the cost, depending on whether the equipment is subject to depreciation and whether prevailing wage and apprenticeship requirements are met.

Make Decarbonization a Sound Financial Choice

The IRA allows a five-year period for the modified accelerated cost recovery system depreciation method for select technologies, which allows for a greater depreciation deduction early in the life of the equipment. For example, when the Clean Electricity Investment Tax Credit is claimed, the cost of the renewable energy and/or energy storage system minus one-half of the tax credit can be depreciated.

Businesses can sell or otherwise transfer credits derived from the Clean Electricity Production Tax Credit and Clean Electricity Investment Tax Credit. Selling or carrying forward tax credits can be attractive to companies that have low or no tax liability and would otherwise not be able to realize the full financial benefits of the credits.

The IRA also provides funding to numerous state-administered grant, loan, and rebate programs, many of which apply to commercial and industrial buildings. The IRA appropriated: